Date and Time

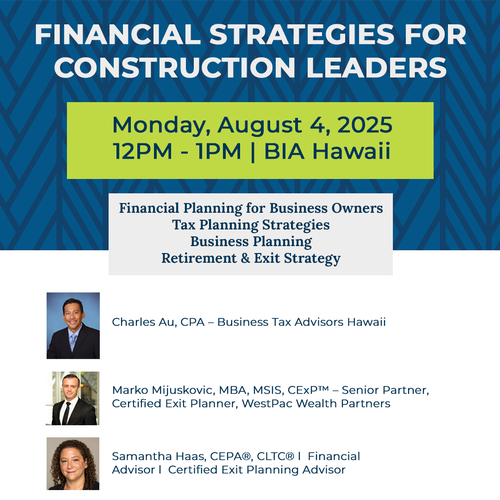

Monday Aug 4, 2025

12:00 PM - 1:00 PM HST

Location

BIA Hawaii, Waipahu

Fees/Admission

NO FEE

Contact Information

Jemma | Membership Coordinator

Send Email

Description

Financial, Tax & Business Planning Update for AEC Firms

In today’s evolving economy, leaders of Architecture, Engineering, and Construction (AEC) firms need clear, actionable guidance to make confident financial decisions. This seminar provides timely updates on financial planning, tax strategies, and business management tailored to the unique needs of AEC professionals.

Key Topics:

- Financial Planning for Business Owners: Align personal and business finances for long-term security.

- Tax Planning Strategies: Explore deductions, deferrals, business structures, and available tax credits.

- Business Planning: Improve business valuation, support employee retention, and address partnership challenges.

- Retirement & Exit Strategy: Review owner-focused retirement options and explore succession and exit planning.

Featured Speakers:

- Marko Mijuskovic, MBA, MSIS, CExP™ – Senior Partner, Certified Exit Planner, WestPac Wealth Partners

- Charles Au, CPA – Business Tax Advisors Hawaii

Moderator: Samantha Haas, CEPA®, CLTC® – Financial Advisor, Certified Exit Planning Advisor

This workshop is designed for AEC firm owners, executives, and managers who want to better navigate financial complexities and plan strategically for the future.

*Light refreshments will be served.